Budget Numbers Hot Off The Presses

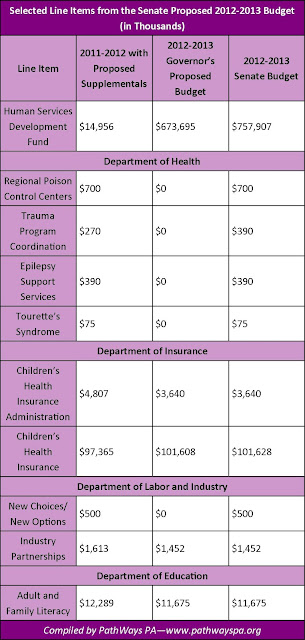

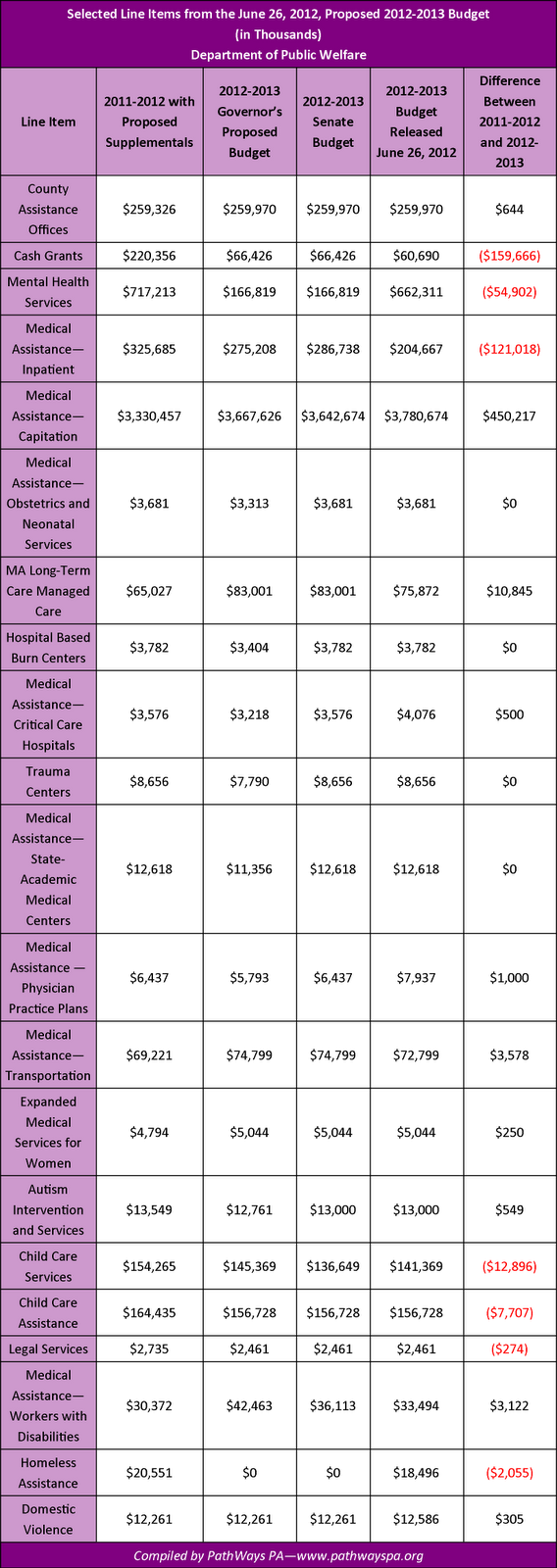

The latest state budget numbers were released earlier this afternoon . This budget includes a spend number of $27.656 million, about $500,000 more than the Governor's budget earlier this year. This budget may not be the final budget, but it gives some insight into where funding will go. The biggest news is the removal of the Human Services Block Grant, which had been under heavy scrutiny since its proposal by the Governor. In February, Governor Corbett contended that creating a block grant would diminish the red tape counties face and provide them with savings as justification for his decision to cut 20% of the funding from the programs included. While the block grant has been removed, possibly in place of some new language around executive compensation , at least some of the budget cuts associated with the grant remain. Several of the items covered under the grant, such as Mental Health Services and Homeless Assistance, have lower budgets than last year. U...